Palantir Technologies, a leader in data analytics and artificial intelligence solutions, has been making significant strides in the global market. With its innovative approach to solving complex data problems, Palantir continues to capture the attention of investors and analysts alike. The company's recent achievements have positioned it as a key player in the tech sector, especially with its expanding role in defense and cybersecurity.

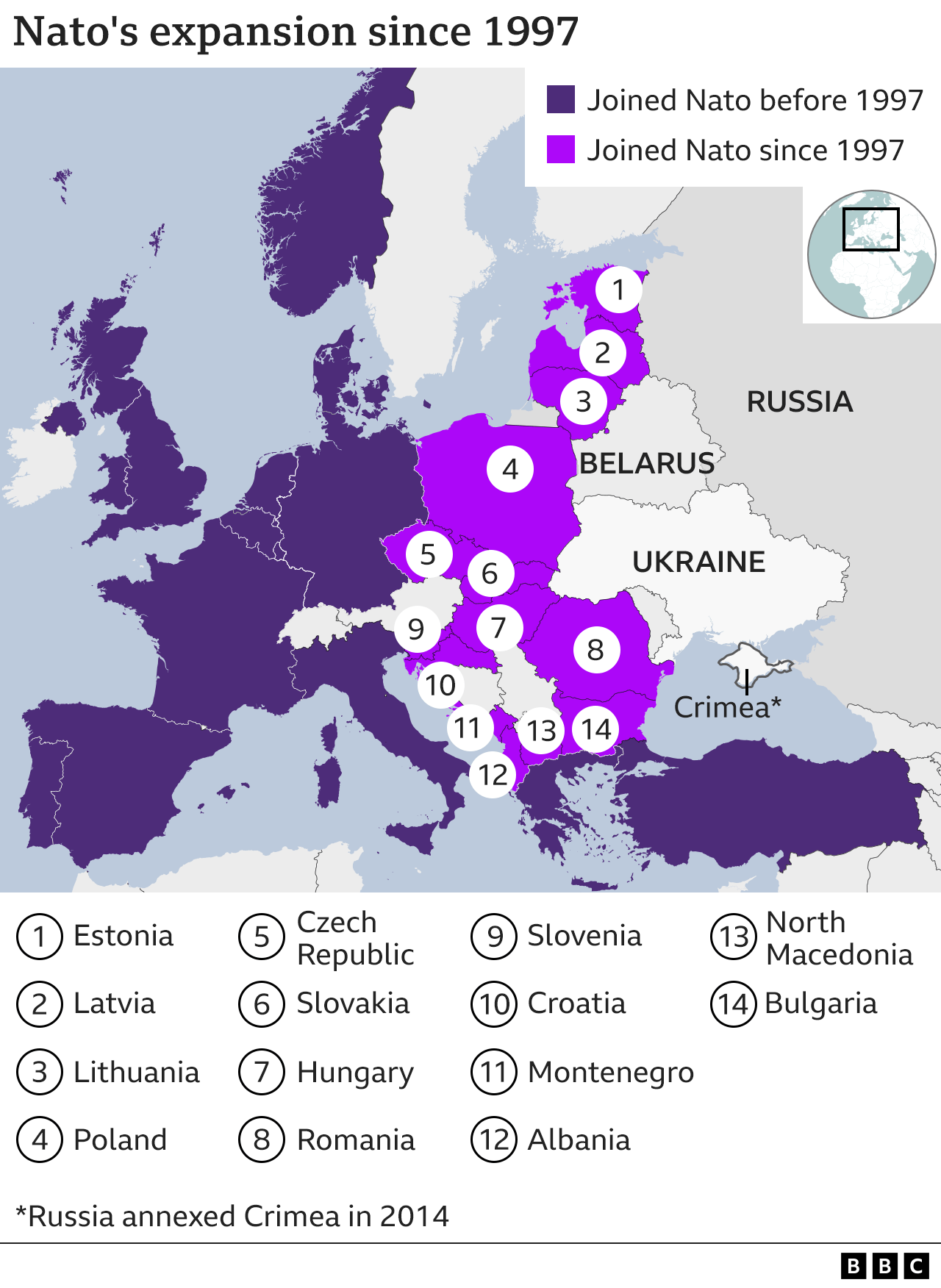

In light of recent developments, Palantir's stock has become a focal point for traders and investors. Following a major contract win with NATO, the company's shares have seen an upward trend, reflecting positive market sentiment. This article delves into the implications of this deal, examining how it impacts Palantir's future prospects and what it means for potential investors considering the stock.

Understanding Cyber Threats: A Canadian Perspective

The National Cyber Threat Assessment 2025-2026 by the Canadian Centre provides critical insights into the evolving landscape of cyber threats. It highlights that adversaries are increasingly viewing civilian critical infrastructure as legitimate targets for cyber sabotage. This assessment serves as a wake-up call for organizations to enhance their cybersecurity measures. As technology advances, so do the methods employed by cybercriminals, necessitating a proactive approach to security.

For Canada, the assessment underscores the need for robust cybersecurity frameworks to protect vital sectors such as energy, finance, and healthcare. Organizations must adopt advanced technologies and strategies to mitigate these risks effectively. By staying informed about emerging threats, businesses can better prepare themselves against potential attacks, ensuring continuity and resilience.

This emphasis on cybersecurity aligns closely with Palantir's mission to provide cutting-edge solutions that safeguard national interests. The company's expertise in data analysis and AI-driven platforms positions it as a valuable ally in combating cyber threats globally, reinforcing its relevance in today's digital age.

Wedbush Ups Palantir Target Price Amid Positive Outlook

Following the announcement of a significant deal with NATO, Wedbush Securities has raised its target price for Palantir stock, citing strong growth prospects. Analysts believe that this partnership will bolster Palantir's position in the defense technology sector, opening up new opportunities for expansion. The firm's innovative AI solutions are expected to play a crucial role in enhancing NATO's capabilities, driving further interest from potential clients.

This optimistic outlook is supported by Palantir's consistent performance in delivering value through its products and services. The company's ability to adapt to changing market conditions while maintaining high standards of quality has earned it recognition among industry leaders. As demand for AI-driven platforms continues to rise, Palantir remains well-positioned to capitalize on emerging trends.

Investors are encouraged by the positive trajectory of Palantir's stock, which reflects confidence in the company's long-term strategy. With a focus on innovation and strategic partnerships, Palantir aims to solidify its presence in the global tech landscape, offering promising returns for those who choose to invest.

Key Price Levels to Watch Post-Earnings Surge

Palantir's stock experienced a notable surge following its latest earnings report, surpassing Wall Street expectations. Analysts recommend monitoring specific price levels as indicators of future performance. These levels serve as benchmarks for assessing the stock's potential movement, providing valuable insights for traders and investors alike.

As the company continues to expand its offerings and strengthen its partnerships, the stock's performance is likely to be influenced by several factors. Market sentiment, driven by developments such as the NATO deal, plays a significant role in shaping investor perceptions. Keeping an eye on these key levels can help stakeholders make informed decisions regarding their investments in Palantir.

With robust demand for its AI platform and a growing portfolio of federal government contracts, Palantir is poised for continued growth. Investors should remain vigilant, tracking the stock's progress against established benchmarks to gauge its potential for further appreciation in the coming months.

NATO Pact Elevates Palantir's Role in Defense Technology

Palantir's collaboration with NATO marks a pivotal moment in the company's journey, cementing its status as a leader in defense technology. This strategic alliance leverages Palantir's advanced AI capabilities to enhance NATO's operational efficiency and tactical decision-making processes. By integrating state-of-the-art systems, NATO aims to fortify its defenses against modern threats, underscoring the importance of technological innovation in contemporary warfare.

This development signifies a shift towards greater reliance on AI solutions within the defense sector. As nations seek to modernize their military capabilities, partnerships like the one between Palantir and NATO demonstrate the transformative power of technology in addressing global security challenges. Such collaborations foster an environment conducive to innovation, driving advancements that benefit both parties involved.

Looking ahead, Palantir's involvement in high-profile projects reinforces its commitment to delivering impactful solutions. The company's ongoing efforts to refine its AI platforms and expand its reach ensure that it remains at the forefront of technological progress, contributing significantly to the evolution of defense strategies worldwide.

Evaluating Palantir Stock: Buy or Sell?

Amidst market volatility, Palantir stock has demonstrated remarkable resilience, gaining over 24% in 2025. Analysts attribute this success to the company's robust AI strategy and promising federal government deals. As earnings season approaches, investors eagerly await further insights into Palantir's financial health and growth trajectory. The upcoming release of Q1 results on May 5 promises to shed light on these critical aspects, influencing investor sentiment moving forward.

For those considering Palantir stock, evaluating its potential involves weighing various factors. While the company boasts impressive innovations and a strong pipeline of contracts, uncertainties surrounding government funding and competitive dynamics must also be taken into account. Understanding these elements allows for a more comprehensive assessment of Palantir's investment appeal.

In conclusion, Palantir presents an intriguing opportunity for investors seeking exposure to cutting-edge technologies and defense applications. By carefully analyzing the available data and staying abreast of industry developments, stakeholders can make well-informed decisions regarding their involvement with this dynamic organization, potentially reaping substantial rewards in the process.